Many people today recognize that getting a high APR bank card can be really advantageous, but some people still do not recognize just how it impacts their score. If you are one of those people that have problem comprehending the effect of bank card on your credit rating, then this article is for you.

Let's take a look at how this affects your average credit history. A charge card is like a loan in several ways and is therefore discriminated than a conventional funding.

To start with, credit cards are really easy to get. Anyone that gets accepted for a card will certainly have an extremely simple time obtaining authorized for another card also. This is one of one of the most important elements of having a card since this implies that you can obtain approved for more than one card on a monthly basis without having to obtain two various lendings.

Charge card are additionally extremely adaptable. They can be utilized for virtually anything, even if it is not a typical funding. As well as unlike lendings, where you can not utilize the card for future expenses, you can use your card for anything.

Among the major reasons that credit cards are so flexible is due to their low rate of interest. Because there is no large down payment or various other major passion settlement, it is not as well tough to make these cards a factor when it involves loan approval.

And also, with the credit card companies backing you up with their credit score score, they will certainly assume that you will pay your bills on time. In order to assure that you will certainly pay your costs on schedule, they want to provide you a high APR charge card. Because there is no penalty for late payments, they will in fact assist you settle your financial obligation by reducing your rate of interest.

With the typical APR credit card, you will pay a bit more in rate of interest, yet you can make use of the card for your way of life and not stress over paying it off. The benefit is that you can obtain a high APR bank card and not worry about being late on your payments.

If you determine to go for the average APR credit card, you will certainly likewise need to pay a bit extra for it. This is since the firms will just give you an APR of around 15% considering that they do not desire you to default on your settlements.

One reason numerous people hop on their credit cards is since they intend to get the most effective rate. Of course, these cards feature their very own charges as well, so if you wish to prevent paying a great deal of money upfront, then you ought to most definitely be considering getting a card with a lower APR

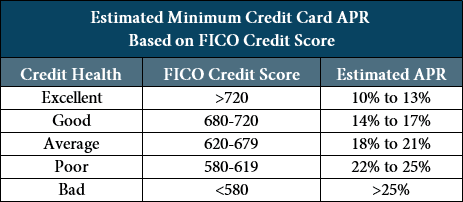

. A poor credit report means that you zero-apr.com will have to pay a higher rate of interest, as well as consequently, you will find it really challenging to obtain a high APR charge card. A good credit rating will certainly allow you to improve rates on your APR cards, which will suggest reduced rates of interest and also perhaps a register incentive.

Nevertheless, despite having the APR bank card, it is essential to recognize how it influences your rating. If you want to acquire a high APR credit card, after that you require to understand exactly how it influences your credit report.

And also, with the credit rating card firms backing you up with their credit history score, they will certainly assume that you will pay your bills on time. In order to assure that you will certainly pay your costs on time, they are prepared to provide you a high APR credit report card. A negative credit history score means that you will have to pay a higher passion price, as well as for this reason, you will find it extremely tough to obtain a high APR credit rating card. A good credit rating will certainly allow you to get better rates on your APR cards, which will mean reduced rate of interest rates and also possibly an indicator up bonus.